Revenue Streams tie together the value creation elements of the business model canvas. This post explores different types of Revenue Streams and mechanisms for generating them. It also explores the financial, strategic, and project management perspectives on Revenue Streams.

Basics of Revenue Streams – Business Model Canvas

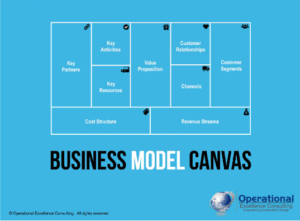

‘Revenue Streams’ is the fifth block in the business model canvas. It is located on the Value Creation side of the canvas and is preceded by customer segments, value proposition, channels, and customer segments.

The Business Model Framework is largely credited to Alexander Osterwalder and Strategyzer. To supercharge your understanding of business models, I recommend his book, “Business Model Generation: A Handbook for Visionaries, Game Changers, and Challengers”.

The Revenue Streams block is important for grappling with a few key questions:

- Value that customers derive and are willing to pay – Evaluate the customers’ willingness to pay based on how the product or service helps with their ‘job to be done‘.

- Multiple revenue streams – Determine the potential contribution to the overall Revenue Stream from different customer segments.

- Payment mechanism – How would customers like to pay? Is it cash, credit card, online, bank account debit, or something else?

Indeed, without Revenue Streams, the business will not survive!

There are several perspectives from which you can view Revenue Streams. This post looks especially Revenue streams from financial, strategy, and project management perspectives.

But first, let’s look at the various types of Revenue Streams and different ways of pricing.

Types of Revenue Streams

There are seven commonly cited types of revenue streams.

There are seven commonly cited types of revenue streams.

- Asset sale – This is the most commonly recognized Revenue Stream. It consists of simply selling the ownership rights to a product. Usually buyers will have the rights to use the product as they desire, and they can resell or dispose of the product when they want.

- Usage fee – A usage fee Revenue Stream is based upon how much the buyer uses the product. Examples include cell phone usage, consumption of support hours, or possibly mileage for delivery services.

- Subscription fees – Many web content sites charge a monthly subscription fee, at least for a higher level of access. Software as a Service (SaaS) provides the use of software for a monthly fee. Brick and mortar gyms provide monthly subscription, or membership, fees.

- Lending/renting/leasing – These provide the opportunity for the buyer to limit their level of commitment to an asset. A person rents an apartment, and a business leases commercial real estate. Also, consumers rent cars on demand – for days or even hours.

- Licensing – Usually related to intellectual property, licensing permits users to utilize the property for a one-time or recurring fee.

- Brokerage fees – These are charges for intermediary services – the service of connecting buyer and seller. Fees can be paid by buyer, seller, or both. Real estate transactions are a common example.

- Advertising – Newspapers traditionally relied on advertising as a main source of revenue. In more recent years, web media companies, such as Google and Facebook, have built revenue models around advertising. These web-based models have allowed very close matching between value and cost.

There various Revenue Streams are not exclusive; there can be more than one, and they can be pursued in various combinations and hybrids.

Pricing Mechanisms for Revenue Streams

There are actually many ways that pricing can be done. They fall under the broad approaches of fixed and dynamic pricing.

There are actually many ways that pricing can be done. They fall under the broad approaches of fixed and dynamic pricing.

Fixed pricing mechanism

- List price – Prices are fixed and not negotiable. This is common in brick and mortar stores as well as the internet.

- Variation with product features – This can be based on overall variation of the product – such as a high, medium, and low versions. Or they can be based on customer choices made at time of purchase, such as color or specific feature choices.

- Variation by customer segment – Different customer segments usually have different ‘jobs to be done‘, and different value associated with the product or service.

- Volume purchases – Often businesses offer different price points based upon how much the customer purchases.

Dynamic pricing mechanism

- Yield management – The price can vary depending upon inventory levels at time of purchase. Common examples include train, airline, and hotel pricing.

- Negotiation – Each transaction is based upon negotiation between buyer and seller. This is common for large purchases, such as homes and automobiles, or in volume purchases.

- Real-time – Pricing of certain commodities, such as oil, often fluctuates in very tight, near real-time time frames.

- Auction – Prices are determined by competitive bidding within a controlled environment and time frame.

- Step-up based on timing – Sometimes time-sensitive offers are made, such as a sale price for several days, and after expiration there is a higher price.

These are the basic pricing mechanisms, but some creativity can yield some additional combinations or even fresh approaches.

Financial Perspective on Revenue Streams

The financial perspective on Revenue Streams is focused on giving a clear picture of where revenue is coming from, and in analyzing and forecasting Revenue Streams.

The financial perspective on Revenue Streams is focused on giving a clear picture of where revenue is coming from, and in analyzing and forecasting Revenue Streams.

The following are Revenue Stream sources based on a financial, or fiscal, perspective:

- Transaction-based Revenue – Revenue based on the one-time – potentially repetitive – sale of goods and services.

- Service Revenue – Revenue based on services provided, either fee per services or based on billable hours.

- Project Revenue – Revenue based on significant and large tasks, such as building an asset or implementing a system.

- Recurring Revenue – Revenue based on continuing services, usually after-sales or support oriented.

The financial perspective is interested not only in accounting for what has happened, but in analyzing the meaning of the numbers, and in forecasting for the future.

- Key Performance Indicators (KPI) – Financial performance, actual vs budget, key financial metrics.

- Performance prediction – Forecasting future performance based on a multitude of assumptions.

- Different forecasting models for different revenue models – Developing ‘fit for purpose’ forecasting models based upon the characteristic of segments and Revenue Streams.

See more on the financial perspective in “Revenue Streams” by the Corporate Finance Institute.

Let’s at the more strategic perspective on Revenue Streams.

Strategy and Revenue Streams

Revenue Streams are a core consideration of a strategy, and thus of the business model.

In the business model context, the strategic challenge is how to build a ‘system’ which generates Revenue Streams predictably and consistently. Revenue Streams indeed need to be part of the activities in the organization’s value chain.

—————————————-

I recommend these strategy resources on FlevyPro (paid links):

| Business Model Canvas 140-slide PowerPoint deck and supporting PDF  |

| Business Model Canvas 22-slide PowerPoint deck  |

| Business Model Canvas: Guide, Process and Tools 43-slide PowerPoint deck  |

| Business Model Canvas – Implementation Toolkit Excel workbook and supporting ZIP  |

—————————————-

In the business model canvas context, Revenue Streams relate closely to several blocks on the canvas, particularly on the Value Creation side of the canvas:

- Revenue Streams to Customer Segment(s) – The choice of customer segment(s) is highly strategic and sets upper and lower limits to the value of Revenue Streams that can be realized.

- Revenue Streams to Value Proposition – The value proposition makes the business case: the business creates value, and can sell it to the customer for a price they are willing to pay based on their value gained. That value sets the stage for the potential Revenue Streams.

- Revenue Streams to Channels – Channels of communication and channels of distribution both have a direct relationship to the Revenue Streams that can be generated.

- Revenue Streams to Customer Relationships – How the business acquires new customers, retains existing ones, and grows sales by scaling those relationships has a direct impact on Revenue Streams.

The business model canvas helps to tie strategy more closely to implementation.

Project Management and Revenue Streams

Here are two angles that the practice of project management has on Revenue Streams:

Projects for revenue generation (revenue center)

Many projects are performed on a contract basis, where projects are the business. Indeed, one of the Revenue Streams cited above is projects.

Projects as a revenue source can be sold and priced in many ways. These include fixed price bidding, cost plus a fee, and hourly billing rates. In all cases, since a portion of project revenue contributes to overhead and profit, it is important to ensure the business sells and executes enough projects to cover overhead and profit.

Projects as a revenue center create value for the business. Skill at pricing and managing customer and stakeholder relationships is an important element to generating more business (more projects) and for creating optimal value for the business and customer.

Value added to support revenue generation (cost center)

Projects here play a support role. While they do not generate revenue, they do contribute to creating value.

A consistent theme in this blog is that project managers need to clearly understand the strategic purpose of the project, and devise metrics to measure projects based on support for strategic goals. This can be a challenge if and when projects are solely looked upon as a cost center.

—————————————-

I recommend these PM templates (paid link):

—————————————-

Although projects are bucketed as a revenue center or cost center, all projects need to add value in some way. I believe that project value is enhanced when measured based on strategic achievement – such as measured by effectiveness at implementing a strategy that generates Revenue Streams.

You can quickly and conveniently work through the Revenue Streams and other components of the Business Model Canvas with the Lucidchart Business Model Canvas template (Try for free) – recommended!

Please share your thoughts and ideas on Revenue Streams and project management below.

Resources

To supercharge your understanding of business models, I recommend “Business Model Generation: A Handbook for Visionaries, Game Changers, and Challengers” by Alexander Osterwalder.

For a good video overview of Revenue Streams (a startup perspective), I recommend “Business Model Canvas Revenue Streams and Pricing” by Steve Morris of StartupSOS: