Strategy has always existed, but Michael Porter was the first to create a comprehensive framework for thinking about strategy. His initial framework, and those that followed, are rooted in basic economics, but they extend economics from an aggregated view of the world down to the industry and organizational level.

Porter’s original strategic framework from the early 1980’s, the Five Forces Framework, is still relevant and useful today.

Michael Porter’s Five Forces and Industry Structure

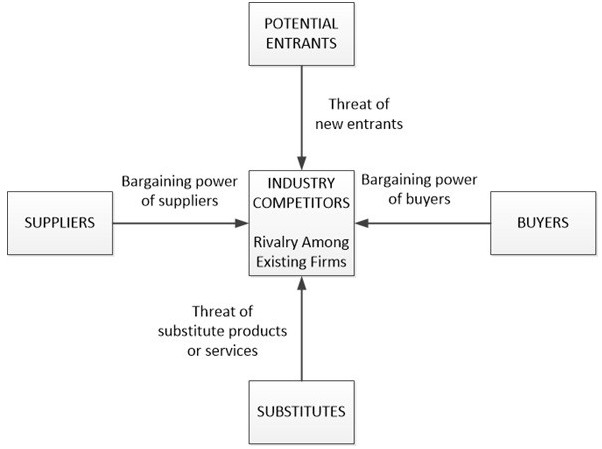

The following diagram illustrates the five forces that together form the composition of an industry structure. It begins to describe the basis for competition in that industry.

Each industry has its own unique structure, and firms compete for advantage within that structure. The five forces framework is illustrated in the following diagram.

Here is what each of the five forces means:

- Industry competitors – Rivalry among existing firms: Companies in any given industry compete vigorously with each other to better position themselves. Economic theory has stated that firms compete to the point where marginal return is zero, thus discouraging any further companies from entering and competing in the industry. However, in reality there are winners and losers among industry competitors. Industry competitive factors include the number and the size of competitors, industry growth versus stability, fixed versus variable costs, product differentiation, switching costs, the level of exit barriers, and others.

- Buyers: Buyers, or customers, in an industry may have substantial bargaining power…or at the opposite extreme, may have almost none at all! It depends on such factors as the relative volume any particular buyer purchases, standardization of the product/service, the potential ability of the buyer to switch purchases among different industry rivals, the cost relative to other buyer costs, the critically of quality, and the buyer’s product knowledge.

- Suppliers: Suppliers have the potential to raise prices or reduce quality, thus tightening industry profitability. The power of suppliers – the degree of influence they have – is effected by the number of suppliers, their size relative to the industry they supply, their vulnerability to substitutes, the relative importance to the supplier of selling to the particular industry, the critically of the supplier’s product as an input to the industry, and the threat of the supplier(s) to integrate with and become part of the industry.

- Potential entrants: This refers to the degree of ease with which new players can enter the industry. Industries naturally have barriers to entry, including economies of scale, product differentiation, switching costs, access to distribution channels, cost disadvantages independent of scale, and government policy.

- Substitutes: Industry scope needs to be broad enough to consider the reality of substitute products. For example, the rail and airline industries need to be considered in the context of all modes of transportation, since there is always the possibility of substitution of one mode of transportation for another. Usually, substitute products are a threat when there is potential for a price or performance improvement for buyers, or if the substitute product or service has a more favorable cost structure and will produce more profit.

There is a friction between each of the four outlying forces and the middle force of rivalry among industry competitors, and that friction is much of what characterizes the industry. Industry competitors are affected by the threat of new entrants, the threat of substitute products or services, the bargaining power of buyers, and the bargaining power of suppliers.

You can get right to the core of Michael Porter’s thinking in his two seminal books, “Competitive Strategy” and “Competitive Advantage“, as well as “Understanding Michael Porter” by Joan Magretta.

And of course there are more excellent Michael Porter books.

|

|

|

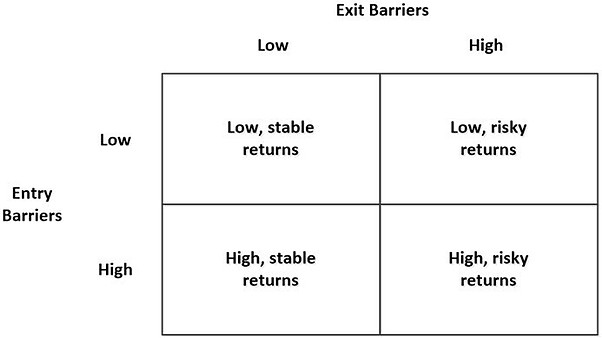

Barriers to Entry and Exit and the Five Forces

Among the forces effecting rivalry among existing firms is the existence of entry and exit barriers. High entry barriers exist when it is difficult for new competitors to enter the industry. Low entry barriers exist when it is easy for new competitors to enter the business and gain a foothold in the industry.

Similarly, it can be easy or difficult for firms to exit the industry, independent of barriers to entry. When there are low exit barriers, it is easy for firms to exit the industry when conditions become unfavorable. When there are high exit barriers, it is difficult for firms to exit the industry when conditions become unfavorable, which puts pressure on profitability.

The chart shows that when there are low entry barriers and low exit barriers, the returns to competitors tend to be low but stable. When entry barriers are low but exit barriers are high, returns are still low, but unstable and risky. When entry barriers are high and exit barriers are low, returns are high and stable. When entry barriers are high and exit barriers are also high, returns are high but unstable or risky.

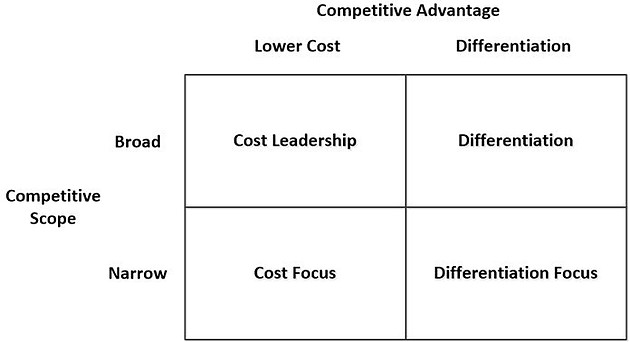

Competitive Scope, Competitive Advantage, and the Five Forces

The following matrix provides a simple tool that provides some context for companies and how they position themselves in their industry with respect to the five forces. As the chart shows, competitive advantage is mapped to competitive scope. Competitive advantage is split into two approaches: striving for lower cost, or striving for differentiation from other competitors. Competitive scope is divided into two approaches: having a broad scope of activity or a narrow scope.

Thinking about a firm in terms of where they fall in the chart, or where they might target, provides some insights for positioning the organization. Where competitive advantage is targeted through a lower cost approach combined with a broad approach to the competitive market, the overall approach is one of cost leadership. Where competitive advantage is targeted through a differentiation approach combined with a broad approach to the competitive market, the overall approach is considered to be one of differentiation. Where competitive advantage is targeted through a lower cost approach combined with a narrow approach to the competitive market, the overall approach is one of cost focus. Where competitive advantage is targeted through a differentiation approach combined with a narrow approach to the competitive market, the overall approach is one of differentiation focus.

—————————————-

Do you need some professional slides for a presentation on this or related strategic topics? I suggest the flevy Marketplace for Business Best Practices, and consider these particular Michael Porter documents:

| Strategy Classics: Porter’s Five Forces (28-slide ppt) – $25 | Strategy Classics: Porter’s Value Chain (23-slide ppt) – $25 |

—————————————-

Competitive Strategy in Project Management

—————————————-

I recommend these PM templates (paid link):

—————————————-

The more the project manager and team can understand the strategy and how the project maps to it, the better. Michael Porter’s five forces framework and related concepts of barriers to entry, competitive advantage, and competitive scope are helpful frameworks for thinking in terms of competitive strategy. To understand your organization’s strategy, use the framework to think carefully about the forces at work in your industry and the organization’s position within it.

In thinking about where it applies to your project, here are some approaches to consider:

- If your project is in a very basic industry, effected to a limited degree by digital technology, the five forces framework applies directly. Use it to frame the purpose of your project in strategic terms.

- In most cases, even basic industries today are finding ways to advance using digital technology, and that is where many of the projects exist. Consider how digital technology can be a disruptor as a threat in the five forces framework.

- If you are working on projects in a highly digital context, think about the frameworks of the industry(s) that you are touching. While you may consider other strategic approaches, using the five forces approach should yield some strong insights on the overall strategy.

- If you are working on projects in the public sector, you likely will be interfacing with private sector industries, and it is extremely helpful to consider the structure of the industries you are touching.

Conclusion and Further Resources

This post described Michael Porter’s five forces framework and how it fits for applying strategy in project management. Although it is older than most strategic frameworks, it also is foundational and very much worth mastering and applying. It is most helpful to understand the framework, understand how it applies to your industry, and then map its outputs for your organization to the purpose of the project, and the metrics by which project success is measured.

To learn more about Michael Porter and his strategic frameworks, see the Institute for Strategy and Competitiveness at Harvard Business School.

—————————————-

Do you need some professional slides for a presentation on this or related strategic topics? I suggest the flevy Marketplace for Business Best Practices, and consider these particular Michael Porter documents:

| Strategy Classics: Porter’s Five Forces (28-slide ppt) – $25 | Strategy Classics: Porter’s Value Chain (23-slide ppt) – $25 |

—————————————-

The following are my three favorite Michael Porter books (paid links, also pictured below):

- “Competitive Strategy: Techniques for Analyzing Industries and Competitors“, by Michael Porter

- “Understanding Michael Porter: The Essential Guide to Competition and Strategy“, by Joan Magretta

- “Competitive Advantage: Creating and Sustaining Superior Performance“, by Michael E. Porter

And of course there are more excellent Michael Porter books.

|

|

|

—————————————-

I recommend these strategy resources (paid link):

—————————————-