What do you get when you combine Agile with Strategy? If there is such a thing, I would call it Strategic Agility Competency.

Strategy, like project management, is plagued with the dilemma that while planning is good, the world changes so fast that the time it takes to plan can result in a changed value proposition, resulting in lower value produced. The more static approach to strategy as depicted in Michael Porter’s Five Forces has some of the same pitfalls as the waterfall approach to project management.

The solution to that has been agile project management, where short time cycles – sprints and iterations – result in near term solutions that add value in near real time.

The practice of strategy implies long term thinking, targeting a vision for the future. So how do you craft strategy in a world that is rapidly and constantly changing?

This post examines a theory around strategic agility, how agile can be applied to the strategy function, and how project, program, and portfolio managers can achieve higher value results under constantly changing conditions.

Use Strategic Agility Competency to Harvest Transient Advantage

The above section title may seem a bit loaded with jargon – sorry about that! – but it does serve its purpose…

Just as projects collapse into sort of mini-projects when moving from waterfall to agile, long term strategies can morph into min-strategies for what Rita Mulcahy calls ‘transient advantage’ in her book “The End of Competitive Advantage”.

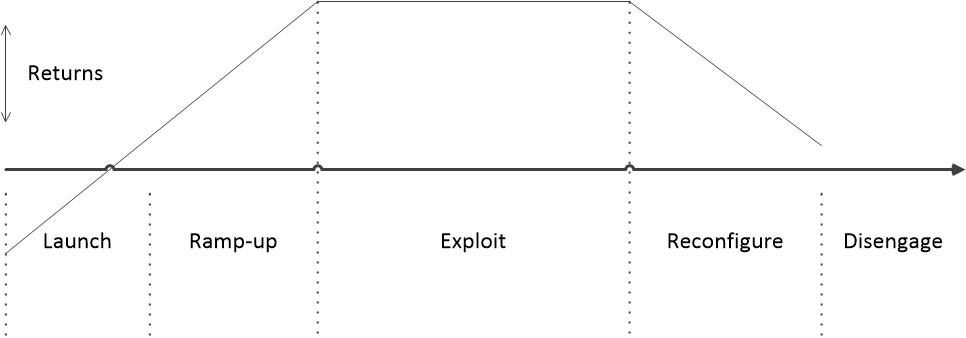

The figure shows five (5) phases of transient advantage, which are closely aligned with the product life cycle and business life cycle frameworks.

In terms of thinking about financial returns (vertical axis in the figure) in each phase, the phases of transient advantage align closely with ideas in the BCG growth share matrix framework.

- Returns are negative in the Launch phase, where cash investment is made for little short-term return.

- During the Ramp-up phase, there are increasing cash outflows, but cash inflows are growing even more.

- The Exploit phase is like the Cash Cow, where returns are high due to high cash inflows coupled with low cash outflows.

- The Reconfigure phase is marked by decreasing returns from declining business, and where resources are being transitioned elsewhere.

- Finally, the Disengage phase is marked by an eventual dissolution of the business.

Transient advantages vary in return and length, but they do exist, and the message is to recognize it, accept it, and do not ignore or resist it.

How Companies Compete

The main point about transient advantage is that it is ‘transient’, or temporary – and thus the way that companies compete on a different basis than in the past. Unlike competitive advantage, which tends to be more permanent, transient advantages in our more rapidly changing world have shorter time frames.

As a result, the basis for competition closely related to competitive advantage are transitioning to a new basis for competition that more closely aligns with transient advantages, as depicted in the figure to the right.

Let’s take a closer look at how each of these ways to compete in the graphic are changing from competitive advantage to transient advantage, and how they represent a more strategically agile approach.

Not Industries – Arenas

Competitive advantages within industries are transitioning to transient advantages in what Rita Mulcahy calls ‘arenas’.

Competitive advantages within industries are transitioning to transient advantages in what Rita Mulcahy calls ‘arenas’.

An arena is a smaller entity than an industry, and has unique characteristics and drivers. The borders of arenas, unlike industries, tend to be wide open, a reflection of competitive threats and opportunities beyond borders defined by an industry. The resources and methods in one arena may differ from those of other arenas, and may extend beyond the industry.

Within an organization, which presumably competes in multiple arenas, there should be some commonality across the arenas it chooses – such as customer, type of solution, geography, operational support required, or other factors. Some key differences when competing in arenas are:

- Competitive activities tend to be more characterized by capturing territory than achieving positional advantage

- Disrupting an established business model instead of exerting force within industry norms

- Behavioral definition of customer segments as opposed to geographic or demographic

Let’s look at some of those differences found in arenas in more depth.

Positional Advantage: Capture Territory Instead

Positional advantages in an industrial context are giving way to capturing territory in an increasingly digital context. While positional advantages still exist and are useful in many situations, business has moved in a more digital, network oriented direction, so many businesses are building advantages by capturing territory in some context, often by grabbing the attention of potential customers through network effects.

Positional advantages in an industrial context are giving way to capturing territory in an increasingly digital context. While positional advantages still exist and are useful in many situations, business has moved in a more digital, network oriented direction, so many businesses are building advantages by capturing territory in some context, often by grabbing the attention of potential customers through network effects.

Network effects is a growing factor in strategy and can help achieve transient advantage. A firm’s or a business unit’s location in a pattern of exchange within networks can provide a competitive advantage.

So, it seems that there are two general sources of capturing territory that come from network effects.

- Unique combination of resources, market positions, established accesses, and other more ‘static’ factors

- ‘Status’ – social or economical, as perceived by customers, competitors, partners, and other stakeholders.

Capturing territory usually results from a combination of factors that provide a unique value-added blend of activities that defy imitation – and thus provide protected competitive advantage.

Geography & Demographics Less Than Behavioral & Experiential

Geography and demographics in a more industrial context are giving way to more behavioral and experiential targeting of customers in a digital context.

The internet is largely responsible for this transition, where geography is not nearly the barrier it used to be. Instead of defining target customers based on geography or demographics, they are more effectively defined around behavioral characteristics and experiential needs and desires.

Geography and demographics do still come into play, but by themselves they do not win customers! Behavior-driven approaches and paying close attention to managing and improving customer experience more closely hit the bulls eye for winning customers! Technology has provided the opportunity to do this type of targeting.

Price, Functionality, and Quality Yield to Jobs To Be Done

Competing strictly on price, functionality, and quality is still important, but similar to targeting based on behavioral and experiential factors, targeting jobs to be done is much more effective. It gets more to the real reasons why a customer wants something.

Competing strictly on price, functionality, and quality is still important, but similar to targeting based on behavioral and experiential factors, targeting jobs to be done is much more effective. It gets more to the real reasons why a customer wants something.

Changing the price, modifying the function, or changing the quality of a product or service may have minimal effect of the sales results. However, carefully observing and discovering why customers purchase and use your product or service – their job to be done – you can make much more progress getting close to your market.

Thus, we have arenas that emerge and then decline based upon the job that a customer needs to get done, and where price, functionality, quality, and even cost are less important.

Portfolios of Businesses Smooth the Way

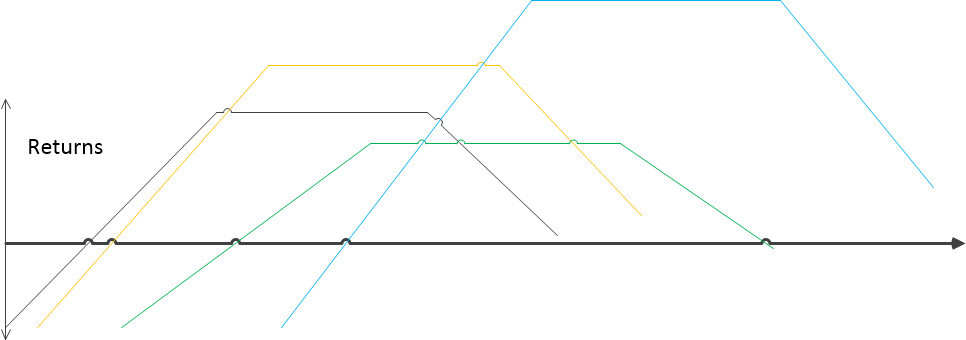

The diagram below is an extension of the diagram near the top of this post. Instead of showing one cycle of transient advantage, it shows a diversity of multiple transient advantage cycles, depicting a portfolio.

The cycle in black is the original one from the diagram at the top of the post. The others, of different colors, show that the variation in steepness, peak returns, and length of time through Launch and Ramp-up phase, the Exploit phase, and the Reconfiguration phase.

The total return from summing the returns, positive and negative, of each color at any point in time along the horizontal axis is the return for the entire portfolio. The challenge for organizations is to maximize return across the portfolio.

That combined return is surely aided by smoothing the transitions across all the depicted curves. It is helpful to be able to move resources – people, equipment, cash and other assets – from portfolio businesses in the Reconfigure and Disengage phases to those in Launch, Ramp-up, and Exploit phases than to have to start over each time.

Agile PM Skills Feed Strategic Agility Competency

What does all of this mean for a project, program, or portfolio manager?

—————————————-

I recommend these PM templates (paid link):

—————————————-

Project managers, at least in more recent years, have transitioned from primarily waterfall skills to a hybrid of waterfall and agile skills. This parallels industry’s transition to shorter product life cycles and business life cycles. Project managers with hybrid skills are exceedingly well-prepared to implement the desired outcomes in an arena-defined environment. Figuring out what customers want, using behavioral and experiential factors and jobs to be done theory, is ripe with opportunity.

Program managers are similarly well-prepared with a more strategic agility competency. Program managers should have the additional strategy savvy to thrive in this environment.

Portfolio managers have obvious challenges, as noted in the previous section. It is a big challenge – but with a big payoff – to be aware of the existence of transient advantage, recognize the transition points, and balance projects across resource needs to achieve the best outcomes.

—————————————-

I recommend these strategy resources (paid link):

—————————————-